Sustainability reporting is a pathway for a company to communicate its performance and impact over a wide range of sustainability topics. It may enable them to talk about the risks and opportunities on their way while giving a clear picture of performance beyond traditional financial reporting. Maintaining trust in stakeholders is a fundamental approach to attracting investors. Organizations across the world embrace the concept of sustainability reporting and several standards have been used to assess and communicate sustainability.

What are ESG Criteria?

ESG or Environmental, Social, and Governance criteria are a set of standards for a company’s behavior used by investors to screen potential investments. Environmental criteria consider how the company takes measurements to protect the environment. Social criteria examine how it manages relationships and interacts with suppliers, employees, customers, and communities. Governance considers a company’s leadership, audits, internal controls, shareholder rights, etc. These criteria encourage investments based on corporate policies and companies to act responsibly.

This can also help investors avoid investment losses when companies engage in risky or unethical activities. ESG investing is sometimes referred to as sustainable, responsible, impact, or socially responsible investing. According to recent reports from US SIF Foundation, investors held $17.1 trillion in assets chosen according to ESG criteria by the end of 2019. ESG standards are consolidated by recent global developments and widely adopted by different reporting frameworks such as CDP, SASB, and GRI, to name a few. Reference (Courage, 2022)

CDP Reporting

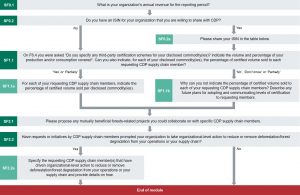

CDP ( Carbon Disclosure Project ) is an investor-led nonprofit organization established on encouraging and supporting companies, cities, states, and regions to measure and disclose their environmental impacts. It runs a global disclosure system known as the CDP Online Response System that organizations use to report the sustainability information requested by their stakeholders. CDP reports are generated using a questionnaire that has grown longer and more complex over the years. For example, the CDP climate change questionnaire has grown to 254 pages in 2022.

Image source – CDP reporting guidance

CDP primarily focuses on GHG emissions but has also developed to address water and forestry issues as well. CDP holds the largest repository for corporate GHG emissions and energy use data. Its transparent scoring system helps respondents understand exactly what’s expected of them. Companies get two separate scores for Disclosure and Performance using a 100-point scale. CDP recognizes top-scoring companies in Carbon Disclosure Leadership Index (CDLI). Reporting periods for different areas are as follows Climate Change program: Feb 1 – May 29, Supply Chain program: April 1 – July 3, Cities program: Jan 1 – Mar 31, and Water/ Forestry programs: Feb 1 – June 30. Reference 1, Reference 2 (CDP Standards, n.d.)

SASB Reporting

SASB ( Sustainability Accounting Standards Board ) was a non-profit organization founded in 2011 by Dr. Jean Rogers who is an environmental engineer and former Loeb fellow at Harvard University. The initial goal was to address the value gap between formal financial statements and the sustainability factors that can add long-term value to a company. SASB initially focused on helping companies operating in the US and since then gained a global level of acceptance allowing 258 institutional investors across 23 countries to use SASB standards for their decision-making. In 2021, SASB and the International Integrated Reporting Council (IIRC) merged into one organization called the Value Reporting Foundation (VRF) in response to investor demand for the simplification of sustainability disclosures. Reference

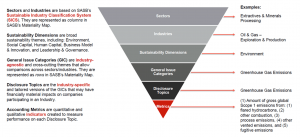

Financial Materiality is core to the SASB standards. If it’s likely that an event or fact would affect an investor’s decision, it is said to be material. Since ESG issues are reshaping the world and how businesses operate, they are material and should be included in materiality assessments. SASB standards consist of 77 industry-specific disclosure guidelines that identify financially material sustainability topics. SASB standards are structured as follows:

Image source – SASB standards

The SASB Materiality Map was created to assist organizations to navigate the SASB standards and investors can use the map to understand how sustainability issues are related across different industries and how they may affect the financial performance of companies within those sectors. The map is organized by 26 general sustainability issues, grouped under five sustainability dimensions. These are then plotted across the 77 industries to indicate how likely a particular ESG issue will be financially material for companies in that industry. The Materiality Finder launched by SASB in 2021 makes it easier for businesses to find the information they need. It has some enhancements such as the ability to find by company, compare up to four industries, easier navigation, and more. Reference (SASB Standards, 2012)

Image source – Materiality Finder

The SASB continues to gain attention from investors and enterprises across the globe due to some unique features such as the strong support from leading global investors, the inwardly focus on ESG issues that could materially impact financial performance, industry-specific guidance, and associated accounting metrics.

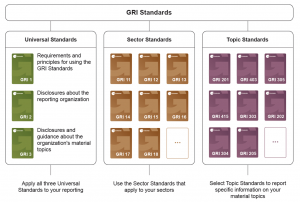

GRI Reporting

The Global Reporting Initiative (GRI) is an independent, international standard-setting institution and collaborating center of the United Nations Environment Program (UNEP). The GRI was founded in 1997, following public outrage over the Exxon Valdez oil spill which is one of the largest environmental disasters of all time. As GRI grew, the reporting was broadened to include the global scope of social, economic, and governance issues. The standards are organized as follows:

- Universal standards apply to all organizations.

Requirements and principles for using the GRI Standards (GRI 1). Disclosures about the reporting organization (GRI 2). Disclosures and guidance about the organization’s material topics (GRI 3).

- Sector-specific standards for 40 high-impact industries.

Standards will be developed for 40 sectors, starting with high-impact sectors, such as oil and gas, agriculture, and fishing. Currently, standards are available for the coal and oil & gas industries.

- Topic standards for specific topics such as waste, health, or tax.

Image source – GRI standards

Many Governments are establishing new disclosure regulations based on the GRI standards. Currently, more than 160 policies in over 60 countries reference or have requirements for GRI reporting. This also improves the transparency of ESG-related financial risks and value creation which can help markets function more efficiently. Organizations can use the standards to report on all material topics and related impacts, or just specific topics such as climate change. While reports using the GRI standards can be published in different formats (standalone reports, websites, etc.), they must contain a GRI content index. The content index makes it easier for stakeholders to navigate through the report. Here are the basic steps for GRI reporting: Reference (GRI Standards, 1997)

- (GRI 1) Understand the GRI Standards system and key elements.

- (GRI 2-3, GRI Sector Standards) Identify and assess impacts.

- (GRI 3, GRI Sector Standards) Determine material topics.

- (GRI 2-3, GRI Sector Standards, GRI Topic Standards) Report disclosures.

There are a few unique features in GRI reporting. It follows an independent, multi-stakeholder process for standard setting, governed by the Global Sustainability Standards Board (GSSB). International advisors ensure GRI standards stay neutral from any specific industry or stakeholder group. It has strong support from policymakers and market regulators around the world. It is outwardly focused on the economic, environmental, and social impacts of a company’s activities.

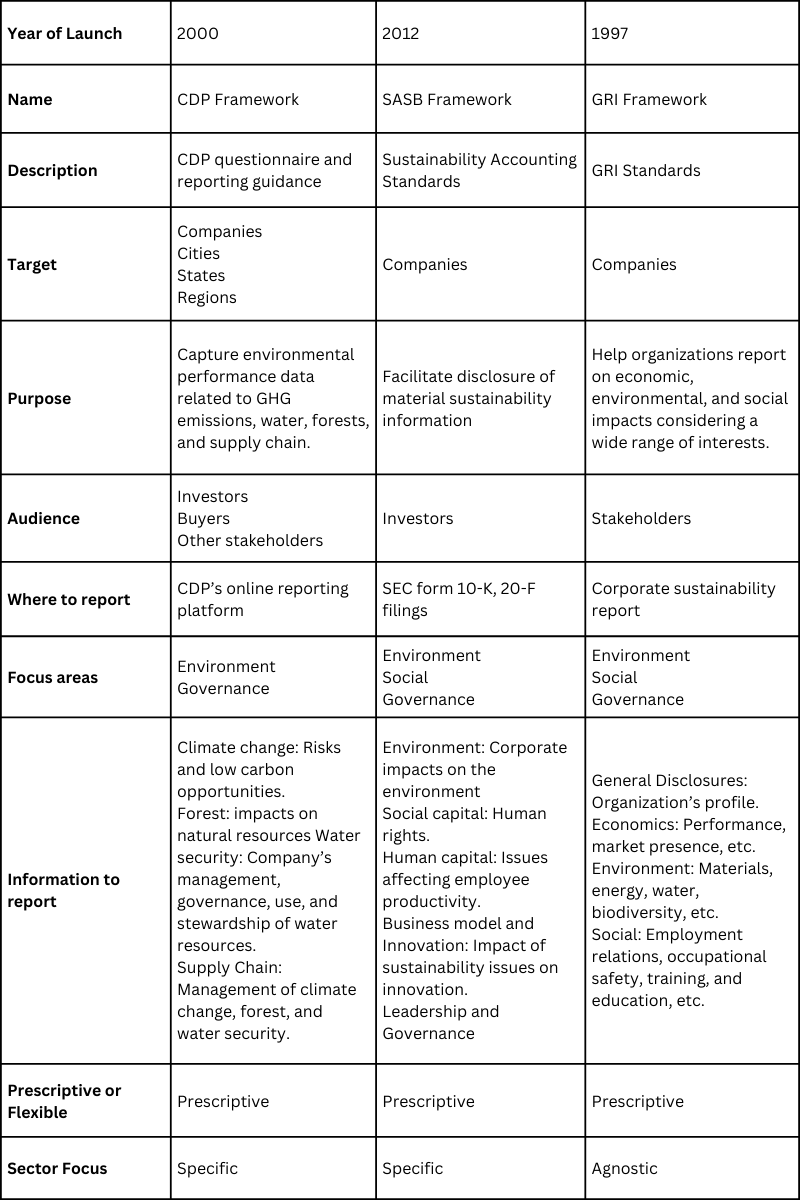

The following table shows a comparison between three major ESG reporting frameworks.

References

CDP Standards. (2000). CDP: Home. Retrieved September 29, 2022, from https://www.cdp.net/en

Courage, A. (2022, September 27). What Is Environmental, Social, and Governance (ESG) Investing? Investopedia. Retrieved September 29, 2022, from https://www.investopedia.com/terms/e/environmental-social-and-governance-esg-criteria.asp

GRI Standards. (1997). GRI – Home. Retrieved September 29, 2022, from https://www.globalreporting.org/

SASB Standards. (2012). SASB Standards. Retrieved September 29, 2022, from https://www.sasb.org/

About The Author: Admin

More posts by admin